Autopilot EA. The final pip count for this week was 125. Not quite as impressive as past weeks but definitely respectable. Based on my initial deposit of $3,000 this is a one-week gain of 4.2%. If I can average this for the year my return would be 217%. Not bad for an $89 software program.

I've been scouring the net for discussion boards, blogs, and honest reviews of this program for over a month. It seems like everybody is having a positive experience with this EA. It has outperformed other commercial EA's that cost significantly more. I'm considering increasing my mini-lot setting to 2 - which would net me a $50 profit per trade. I should be okay if I set a 500 pip stop loss based on my equity balance of close to $3,500.

I have identified one weaknesses of the EA. I am concerned with the high number of long positions it takes. I did not have a single short position all week. This is especially concerning when the price reaches an upper resistance (say 1.5880). If I take a position at the peak it may be a long time before it breaks through the resistance to reach my profit target. Additionally, my opportunity cost is all of the trades that I miss while waiting it to close. My first idea was to set a stop sell at say 1.5870 (+/-). If the price increased to that amount it would enter a short position and the EA would not enter another position until this sell was closed (say at 1.5800). I tested this scenario and found that the EA will not enter new trades when you have a pending order set. On to "Plan B". When the EA has taken a long position close to the upper resistance (say 1.5850) I manually place a short position. The FAP long position will still close when it hits the profit target but it will not open any more trades. This means that I can wait until the short position closes (say 1.5800) and then restart the EA (you will need to manually remove and replace the EA to get it going again). This is not a perfect solution because you do need to monitor it to make sure you place the sell trade before the target is hit and the EA places a new trade. It does however mitigate some of the risk of getting "stuck" with a long position at the peak.

I hope that the creators of the EA will upgrade it to allow the "max orders" option to work. This would allow the EA to open multiple orders. It is currently an option that doesn't work.

Overall I am very satisfied with the performance and would recommend it to anybody to try. Everybody has their own risk tolerance but even at a 0.50 mini-lot setting it will probably pay for itself in a week or so. Here is the website.

I have received a number of emails regarding this program. I would encourage you to post under the "Comments" section below. This would be beneficial to other visitors who have similar questions or would like to learn about other user's personal experiences. I am still fine with answering personal emails if you feel more comfortable communicating directly.

Additionally, I would love to learn about other money making opportunities that you have personally come across. I can either post your own "guest blog" or do my own review of the opportunity. I am open to all types of money making concepts. As you may have read earlier, I am an advocate of the Sports Betting Champ system. This may not be your typical investment but it does provide a nice return at a low risk.

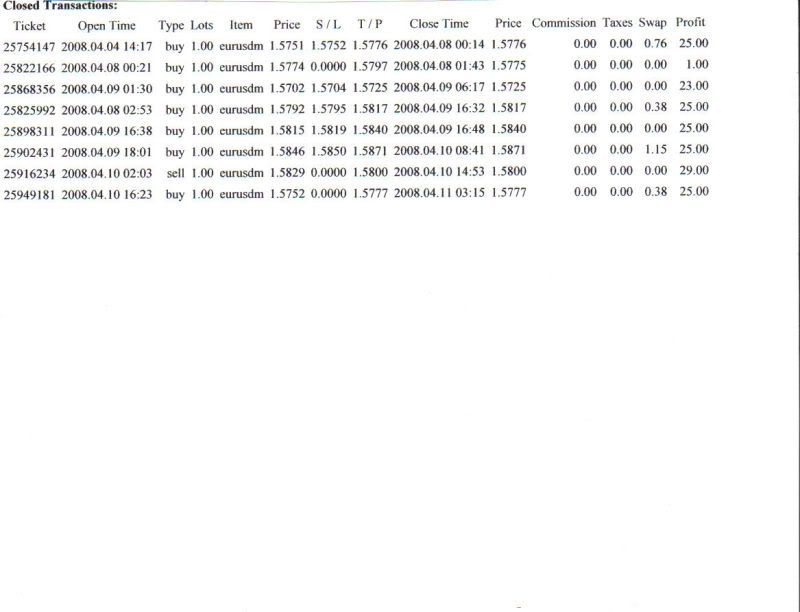

This week's FAP results are posted below. You'll notice two trades that were placed manually. All $25 profit trades were placed by the FAP. I am running the following settings: Lots: 1 ;LRR: 1 ; MO: 1 ; ML : 100 ; aaa: 13 ; bbb:14 ; TP: 25 ; SL: 0 ; TS: 50 ; SG: 0.5 ; SP: 3 ; SGD: 0.2 ; SGW: 0.

Have a great weekend!

Past Forex Autopilot Updates:

Forex Autopilot Update 4/4/08

Forex Autopilot Independent Review

90 comments:

Thanks Craig

Very interesting observations and ideas. I too just switched to using a live account and have been happy thus far.

I've stumbled on a similar concern.

In this case the EA opened a Short position not far from the low of the day.---1.5770

thus I've been running a 200 to 500 pip loss all day. In my case it translates to -$200-$500 using a $5000 live account. It entered this short trade after a number of profitable trades and I was up at $5629.

I've spent most of the day fighting the urge to close the trade. It seemed hopeless to me but, I fought my MM instincts -- I didn't close it and am currently carrying a minus $287. at Friday's close.

I'm a bit concerned about what could happen during weekends. (news, world events, etc)

Here are some things I've been wondering about:

Any ideas how this handles gaps that go against you when the market opens after a weekend?

Do you think it might be prudent to close trades at the end of each week?

Has anyone ever seen this EA close a losing trade on its own? At one point I was down over $500. and thought it might exit as it was near 10% - but no stop.

I also still have a demo account running and notice that it continues to take entirely different trading positions.

My "demo" account is currently Long and closed the weekend UP.

I wonder if trading two separate accounts would minimize risk as each EA seems to have a mind of its own. For example:

I'm currently Short, with a losing trade in my live account, and Long with a winning trade in my other demo account. If there was a gap up on Monday, my live account short position will be in very bad shape but would be offset by the Long position in the other account (if it were live.)

--- I'd have protection from some unforeseen weekend economic disaster.

Anyway, thanks again for your blog and posting your experience.

Jim

Hi Jim,

I'm not sure how you're down 200-500 pips. The EUR/USD price has been trading in the 1.5700-1.5875 +/- range all week. Pips refer to the price change. Your actual dollar movement depends on what your lot settings are at. What do you have your EA set at? Are you trading with a standard or mini account?

I would not worry about a short of 1.5770. Just let it go and you should close soon. I would personally rather be short at 1.5770 then long at 1.5870.

I don't worry about the weekend gaps because the market usually corrects itself after a gap anyway.

I've never seen the EA actually close out a trade by itself (aside from the 1st of the month). There may come a time that you need to make a decision to close a trade manually if the market trend has changed direction.

As far as trading with two accounts...the EA should really make the same trades on both accounts. I could see a benefit to starting up the EA on a separate account if you are currently stuck in a trade in another account.

Thanks for posting your experience.

Hi Craig,

I should have said 20-50 pips.

I keep translating it to dollars.

(I have a one track mind.)

Perhaps I should have my setting on .05--When the trades are in my favor $10 per pip seems great.

I used that setting for a few weeks on the demo and it went so well I felt like I was wasting it on play money.

Still, I've noticed that my 2 EA's seem to trade differently. Started both on the same day. I am up on both accounts but by different amounts as a result of different trades.

During some conditions, the EA seems to open a good number of winning trades which is why I wonder if getting out of a long running painful trade might just make room for more good ones.

However, at this point, I won't try to reinvent the wheel. Everything I've read stresses letting it do its job.

I would just like to know that it won't blow up the account and will actually "exit" an incredibly bad trade.

Keep posting results, they are much appreciated.

Jim

Jim,

I think that $10/pip (1 standard lot) is too high of a setting for a $5,000 account. A few weeks ago I had a drawdown of 450 pips for a short period. This would have translated to $4,500 for you.

Part of MM is your own personal risk level but you also don't want to blow up your account.

I still feel like at short at 1.5770 is not a bad place to be. I'm no expert but I'd bet you'll close within a couple days max.

Craig,

I will definitely be changing my setting. I see now it's way too aggressive; a 400 pip draw down would be disastrous, especially for an account I turned over to a robot.

It's been my experience that the unexpected can be expected.

Like you, I too have noticed (with the exception of the short trade I'm in now,) most every EUR/USDtrade is long. I would suspect this is because the EA has a trend following component that somehow has detected the long term direction of the Euro with regard to the USD.

I wonder how it reacts to major trend changes. I personally don't see one coming too soon (in EUR/USD,)

but no trend continues forever and I've been wrong many times before.

Once this trade is done, I'm will be reducing my risk. I had the idea that the EA capped my maximum risk at around 10% (still higher than my tolerance) but began to get the willies when I watched it enter that % loss range several times without exiting.

Take Care,

Jim

Thanks Craig for sharing. Having just purchased this EA, any comments are welcomed.

I do have a problem with a system that trades off a 1-min chart taking too long to close a position. Also the draw down it condones doesn't make sense from a risk/reward standpoint.

Good luck with tweeking as we'll be following your findings.

Hi Jim,

I have seen 2 trades that closed out by itself on April 10th on default settings. At 1 lot, they lost $210 & $150 (21 & 15 pips).

There were also 2 winners for $200 (20 pips) each on same day.

On the other hand, when I accidentally applied FAP to gbp/usd on Apr. 8th, it had a run-away trade down 200 pips before I pulled it.

In my humble opinion, a system trading off a 1-min chart should not be in the trade very long. If we look at Carig's statements, one can see several trades that took profit fairly quickly within minutes or an hour.

In my opinion, any trades lasting more than about an hour means that their system for exit is:

A) unable to trigger profit at 20 pips (default) due to the move (retrace/wave) being small.

B)ignores safety measures by taking on huge draw downs in hopes that market eventually comes back in trader's favor.

All of the examples of this EA coming back from a large DD may be just luck.

The EA's indicators would only analyze a predetermined amount of data in previous 1-minute bars. To assume that they are still working after several hours and 100's of pips behind is not realistic to me.

In any event, glad I found this blog enabling us to all share our opinions and experience.

Cheers

Wow,

Craig,

You were right about the short trade, and so was the EA. The market just opened gap down about 100 pips so I picked up about

$800. on that trade.

The gap was in my favor, however had it gone the other way, (up) I would now be down about $1287. Thus, it seems weekend gaps "could potentially be" quite treacherous if you are set up on the wrong side of the market in an underfunded account.

Either I lucked out here or the EA is truly reading all the signals correctly. I really was feeling bad about that particular trade and almost exited at a loss of $287.

Pleasantly flabbergasted,

Jim

Hi fxisland,

May I ask the size of your base account when it closed out of those 21 and 15 pip trades?

Did it seem like it was at 10% of your account value at the beginning of the trade?

I don't know where I got the idea of a 10% account risk, but I'm sure I read it somewhere.

I'm just trying to figure out what triggers an exit. My base account was $5600 when it took what was (in my mind) a worrisome short position on Friday.

At one point, my live account was down was about $510. (51 pips) That is not quite 10% based on $5600. at the beginning of the trade.

The trade went strongly in my faver due to a gap down this evening so I'm thrilled, but still would like to understand why the EA closed trades at 15 and 20 pips ($150. and $200) in your account, but ran in excess of 50 pips

($500) in mine.

True, if it had exited I would not have picked up the $800. profit on the trade, but I'm still scratching my head about how it works. How could it have possibly been able to predict a profitable gap down for me.

My other account which is only a demo was long over the weekend so it should look pretty bad when I see it on my office computer tomorrow morning.

Perhaps my exit mechanism is not funtioning?

Jim

Hi guys.

New to this so please excuse the ignorance.

I will soon be purchasing the autopilot here, but for now I downloaded the interbankfx trader4 and am wondering what are the optimum safety to profit ratio settings to start with a $10,000 mini demo account emulating a perhaps soon to be live account of the same settings?

(Read somewhere to use mini account but trade more lots instead of regular acc. since spreads are the same now.)

All I know for sure is the less leverage the better if I have the money to put in the account - I guess. (Slow learner)

Thanks everyone!

P.S. By all means please respond to this post whenever it is convenient, as I know there are other questions awaiting answers.

Great discussion everybody.

fxisland - It's been my experience that the EA does best when the market is trending upward with little volatility. I closed 5 trades in one day (two Fridays ago)during an upswing.

I'm surprised you had two trades that automatically closed out. Are you using the old EA (no activation code) or the new v2.0? I haven't upgraded yet.

I agree that the DD can be high if the market makes a permanent change in direction. I think you need to monitor your trades and possibly close out a loss if necessary. As successful as this EA has been you should still have a decent net even after a large (500 pips?) loss.

Jim - Glad your trade worked out. Can't say I predicted a 100 pip gap. My open buy is now sitting on a 150 pip DD. I'm not too concerned though.

What did you change your live account lot setting to? You could probably do 2 mini-lots on a $5K account if you're aggressive.

newtrader - Welcome to the wonderful world of Forex! I would set your demo account up similarly to your future live account. For example if you plan on depositing $3,000 then set up a mini demo account with a $3K balance. This way you can get an idea of how your real money account will work. This will also help you determine how much you want to risk.

If you appreciate this site, please do me a solid by purchasing the product through my link. It gives me some incentive to keep it going :-)

Craig

Purchasing the autopilot through this site is a given. I would have it no other way!

If I plan on having a live $10K mini account in the near future, what leverage should I input in interbank fx trader4? (demo acc. for now.)

For some reason - maybe because of my thick skull - I can't wrap my mind around the concept of leverage as it pertains to risk and my wanting to trade a 10K mini acc. in essence gaining (or losing) $10 a pip. And also, what would the optimum leverage be that I would use, ie. 100%, 50%, ...1%?

I think I should stick to working on cars maybe. LOL.

Meant to say;

100:1, 50:1, 1:1, leverage etc.

I guess I would need at least 10:1 to trade $100,000, and 100:1 (probably what I should use) to trade $1,000,000.

Good thing I don't get headaches, or I'd have a migrane.

newtrader- Default leverage for an IBFX mini account is 200:1. This will mean that you need $50 in equity (your cash balance) for every mini-lot you trade. 1 pip equals $1 when trading EUR/USD with a mini account.

Since you have a larger account, you can always trade larger mini-lot sizes. i.e. - My $3,000 account is set to 1 mini-lot trades, you could set yours to 3 mini-lots. It just depends how aggressive you want to be.

Here is a great tutorial on margin.

It's not as scary as it sounds as long as you're not over-trading. You basically have to use margin to make money because the price movement is so small as compared to a stock price.

jim,

The demo that i started with had a large $100K start. This EA has what the developer terms as "internal" functions that exit trades. Of course we don't know the parameters, etc.

"My other account which is only a demo was long over the weekend so it should look pretty bad when I see it on my office computer tomorrow morning".

__________________

We'll, I just started new demo with $10K set with Carig's adjusted parameters for aaa:13; and bbb:14.

It made 3 trades tonight for +200 (1 lot 20 pips) each thus far.

I am now in a 4th consecutive buy, with each new trade practically triggering right after the other winners closed out.

You can always turn off FAP on Fridays if you don't want to chance going into the weekend. Alternatively, if you are stuck in a trade already, see hedge option below.

craig,

Thanks again for sharing. I had noticed previous to changing the aaa & bbb that I had much different demo results on April 10th versus yours. Those were the 4 trades mentioned by jim, 2 winners and 2 losers.

As far as monitoring trades to exit...maybe better to just enter an opposite position hedge when it gets uncomfortable. Personally, I would do this at minus 3% of account balance. Release hedge when position re-enters comfort zone.

Welcome newtrader..I'm also new to this blog but have traded before. Whatever we can do to help, just ask.

Subsequent to my last post, it is important to note that this EA will exit another existing trade if it is just loaded. I had a losing demo trade that it closed out on gbp/usd.

Jim, this means if you enter a new hedge position you should at the very least use another chart.

Maybe Craig can comment on this as it may be required that we have to open another platform.

jim,

Realized I did not answer your question. Your short was on Fri Apr 11th, while my 4 trades were on Thurs Apr 10th (default settings).

As noted, I've changed my default aaa & bbb settings to Craig's, effective today Sunday night.

Sorry for posting again, up with market like a true/old FX trader.

Jim, I pulled the old demo up and did have a EA short trade Fri 11th.

Entry Apr 11th 02:00 @ 1.5756

Exit Apr 14th 00:00 1.5736

I now remember this trade as it was behind 99 pips. That's when I found this blog as it concerned me.

Difference, of course, is that you have a live account.

fxisland - I'm with you on the hedge trades. When the market gapped down last evening I opened a manual buy at 1.5685 and closed out overnight at a 65 pip profit. My FAP trade remaining from Friday was a buy at 1.5829. I set a pending sell limit order at my profit target of 1.5854. This way the EA would not open a new trade once the existing trade closed. I didn't want to enter a buy towards the upper resistance. This AM my FAP buy closed at a 25 pip profit, my sell limit order was triggered and then also closed at a 30 pip profit later this morning. I am up a total of 120 pips since yesterday's open; however, only 25 were actually initiated by the FAP. I have now reset the EA to run again.

Craig

I changed the aaa:bbb settings to the recommended settings. I saw a demo test of 9:10 vs. 13:14 and noticed that the recommended settings took more short positions. As far as profit goes, they were about the same. I just decided to use it the way it was meant at 13:14. I do have my profit target at 25 and trailing stop at 50. They are my only "custom" settings.

Craig,

Good moves. Here's what my demo did since inputting your aaa/bbb Sunday.

6 winners for 20 pips each. None of these lasted more than about 2.5 hours. This is the way a system pegged on a short-term chart should trade.

Now for the dreaded trade that goes beyond. In short which triggered Apr 14th 02:00 @ 1.5870.

After grabbing a few hours sleep, woke up to a negative 25+ pips which increased to -40. Identified short-term support around 1.5826 and set sell stop order for hedge. This represents hedging at -50 pips or about 4% of account balance.

This is a good example of the one weakness of EA. What I've done is lock in a worst case -50 pip scenario.

I had fibs drawn from high of 4-10 to low of 4-14. EUR/USD now re-testing 50% fib of 1.5820 after probe to 1.5815.

Since I now have 2 trades going, and need to leave the computer, what can a trader do?

1) I can measure a fib extension and set take profit for the hedge trade. Or use a trailing stop.

2) Leave it alone as far as targeting profit. Set exit for 1.5890 as per original FAP trade. This will result in a loss of -50 pips.

Obviously option #1 seems more attractive. The objective is to limit a run-away negative trade that has operated outside of a reasonable lifeapan.

If option #2 doesn't pan out, all we lose is the locked in -50 pips when we set a stop loss for hedge at the take profit of FAP trade (1.5890).

Will let everyone know how this works out.

Correction typo: If option #1 doesn't pan out, loss locked in at -50 pips.

fxisland - Your lot settings are fairly high as compared to your equity. A 50 pip slide in my account would only represent 1.7% of my original deposit (even excluding my profit). Keep in mind that a few weeks ago I had a drawdown of up to 450 pips which would have been a large percentage of your account. It sounds like you're actively monitoring your trades so as long as you keep an eye on it I'm sure you'll manage your drawdown.

All in all, I had a very good day.

Fortunately, I was on the right side of the Gap down last night, and it then made 3 winning trades while I slept.

I woke with 120 pips which translated into a $1200 profit..

It then entered a long trade this morning near the top of the range at 1.5870.

I wasn't happy about that and

watched it lose for several hours.

Against the FAPS suggestion/recommendation, I manually exited for a 40 pip loss. I just couldn't see it working out and as of 6:45 pm it still wouldn't have.

It then entered long 2 winning trades that retrieved the 40 pip loss.

To reduce risk to my small account (currently $6800)I finally reduced my lot size to .5 and it entered a Short position at 1.5843

As of 6:45 pm the short position is up about 15 pips ($75. with the new less aggressive .5 setting)

Not as exciting on the way up, but the losing trades will not be as hard to swallow especially if something drastic occurs and I'm not there or fast enough to get out.

There is another thing I'm hazy about. Do I understand correctly that I can manually enter a long/short trade as a hedge if I don't like a trade the EA initiates? Specifically, can I have two (opposing) trades running in the same account at the same time with the EA operating?

TIA

Jim

Hi Jim - Yes, you can manually place a hedge trade and it will run at the same time as the FAP trade. There's one catch. Once the FAP trade closes it will not open another trade. You'll need to wait until both trades are closed then remove the EA and restart it.

Is everybody using v2.0 or the old EA?

"fxisland - Your lot settings are fairly high as compared to your equity. A 50 pip slide in my account would only represent 1.7% of my original deposit (even excluding my profit). Keep in mind that a few weeks ago I had a drawdown of up to 450 pips which would have been a large percentage of your account".

_____________________

Hi Craig,

The pair went from 25 pips to 40 pretty fast. I used another account to hedge as I didn't know if I can place another trade while the FAP had on going. Don't know if anyone else is experiencing same, there is a lag time when I log into another account. The platform freezes for 2 to 4 minutes. By that time, I was 40 pips behind. I place the hedge below what I saw as support (1.5826) using a stop sell at 1.5820. Thus the 50 pips, which I agree, at 4% of account balance, is too high. Also, I agree that 1 lot with 11,200 balance is high. But if my mental stop-loss is 30 pips, it's only 2.7%.

I would never allow a trade to go 450 pips behind, hence the experiment with hedge. My current short is locked into the max 50-pip loss.

As Jim has just stated, he pulled trade at -40 pips and got into 2 winners. So this prolonged short, at negative, is preventing me from other trades by EA.

I'll see if short position makes any progress prior to heavy volume during European session tonight. May pull trade. Work in progress. Keep up the good work.

Much appreciated and many thanks.

Hi Jim,

CAn you advise if you are running EA at default settings? If you are using Craig's settings for aaa & bbb, then our trades look different. As mentioned, I had 6 winners prior to the my pending loser that fell behind as much as 76 pips (I hedged at -50 pips).

Let's compare notes. I guess I need to post statements in order for everyone to double-check. Will work on that. Any suggestions welcomed sa I'm not a techie.

Craig, I am using new version 2.0.

My hedge trade is still in play, as pair went down only to 1.5794 and I had set take profit at 1.5785 (ahead of fib extention 1.5778). I also place another sell stop at 1.5770 in event I took profit and pair kept going down. Again, identified support at 100% fib extention 1.5778 for that decision.

Currently, my run-away short is back at -47 pip area and hedge still live.

Reverting with results/decision.

Just pulled hedge short at even. Forgot to check announcements. France has CPI today, and forecast is higher than last. Since France is large player in Eu, would have high impact as per site.

http://www.goforex.net/forex-news.htm

http://www.dailyfx.com/calendar

At 06:45 GMT, we may see spike in Euro.

Although, many of us are techincal anlaysis traders, as well as EA users, we also need to keep abreast of major announcements.

During European session, EUR/USD gained to 1.5874 before massive sell orders triggering ahead of all-time high of 1.5913.

Whip-saw action, as French CPI and German Economic Sentiment announcements were of high impact.

Too bad pair is so close to all-time high, as it takes away from FAP's overall evaluation for the moment.

Can anyone list today's 5-15 FAP trades since I've been stuck in BUY since 4-14 02:00?

Thanks

I'm going to upgrade to v2.0 and see if it enters more short positions.

fxisland - You're right about it being a shame that we're near an all-time high. I think it would've performed great as the EUR/USD climbed to where it is now.

I am continuing to use my hedge trade strategy whenever I open a trade above 1.5800. I used the strategy again yesterday on a FAP buy at 1.5829. I set my pending sell limit trade at 1.5854. The buy closed overnight and I just closed out my manual trade at a 20 pip profit so that I could reset the EA before work.

I'm up 165 pips this week with 50 of them actually being initiated by FAP and the remainder being hedges.

fxisland,

I am using all of the original default settings except I changed the Lot size to .5 yesterday to avoid massive DD's relative to my account size.

Craig or anyone,

I understand that using opposing trades as a hedge will result in having to reload the EA after the trade closes.

What happens if you enter an additional trade going in the same direction. The EA opens one long at 1.5870, the market drops to 1.5800 and you manually open an additional long at that point.

Will this result in disabling the EA after both trades close?

Here's a hypothetical question.

When you access your account from another computer at another location through Meta-trader, could you run an additional EA from that location on the same trading account?

Still trying to figure out other possibilities.

Jim

Jim,

You present 2 very good questions that we all should understand the answers to. I recall reading that when we purchase FAP, it registers the computer it downloads to. I assume we cannot run it on another computer.

As far as running a different EA, that might interfere. Probably have to open another platform all together. There was a blogger that addresses this on ck owyang's blog. Hopefully, Craig can chime in.

If Craig doesn't have an answer to the 2nd long position scenario, I'll just enter it to find out. I would assume that since we have to reload under Craig's scenario, we'd have to reload after closing 2longs.

Craig,

Again, great move with sell hedge waiting. With a live account, one has to be proactive with certain strategies. Everybody has different trading styles. Another trader may have drawn fibs and had a pending hedge at slightly different price. But all in all, the basic prinicple to hedge near solid support/resistance is sound.

UPDATE:

My runaway long is back down to minus 70 pips at the moment. Again, there is no way I believe their indicators are still applicable in protecting this position, in view of aforementioned solid resistance.

While I dedcided to pull it ahead of announcements, the sell hedge at -50 pips @1.5820 with take profit at 1.5785 (ahead of 100% fib extention support of 1.5778) was right on (see previous post). I also used fib of 4-14 high and low and 1.5778 is also the 50% fib.

I also had a pending sell at 1.5770to maintain hedge in event move plows further down. I know all of this sounds complicated. I'd be scalping on the sells as a hedge against losing FA long entry of 1.5870. As you can see, at one time it was down more than 100 pips. We can't allow this to happen if we follow true money management.

Since my long has past what I deem as an acceptable time window for FA, I have to manually intervene.

Jim,

.5 lots on what account balance? It you envision max loss of 40 pips on $10K account, this translates to 2% risk.

All,

Can we somehow post results with both original default setting aaa:9; bbb:10 versus aaa13; bbb14?

Perhaps Craig can advise if we can all post pics of our demo/live statements on another site.

Cheers

Hi fxisland,

My account began at $5000 and is currently hovering around $7000.

I will credit the EA with making all the trades that got me to this number. I went to live trading last Wednesday evening (4 trading days ago at 1.0 Lot size). I reduced lot size to .5 last night.

I've learned that I can access monitor and trade the account from my office computer at a different location. (This is a different computer from the one running the EA.)

Yesterday, I accidentally opened and closed a short position from work while trying to close the long trade I had become too uncomfortable with.

Yesterday (as per my previous post) I manually closed the EA's long trade and my own "mistake trade" all without affecting the status of the EA.

If the EA closes the trades itself (as per Craig) that seems to be another story if its an opposing hedge.

Currently I'm long from 1.5870 and I've decided to let it run "hands off" as it using profit money and a .5 lot size. I'll leave it alone within reason. I still want to try to get a handle on how it works without tampering with its perfomance history.

I wonder if manually closing trades effects the operation of the EA. Is it aware of price action and previous trends? (It seems like it should be learning a good lesson from today's precipitous drop.)

Please let me know how opening an additional trade in the same direction affected the operation of the EA. This could be helpful in mitigating the loss on a losing trade that nears intermediate support.

Jim

Hi Jim - A $2,000 return on an $89 investment isn't too bad!

I just downloaded the v2.0 EA. I'm curious whether it will act differently than the old version. On my current version I can open a long position (running at the same time as the FAP long) but I need to remove and replace the EA after both trades close. For some reason the EA won't make trades. Maybe the new version is different. I'll find out soon.

fxisland - I'd be more than glad to post other user's performance logs on my blog. Just email the file to cwp1979@gmail.com.

Hey Jim,

Great to have multiple feedback.

1) I believe that trading .5 lots on an acount balance of $7K is still too high. If the industry's rule of thumb is to not risk more than 3%, then the max DD you can allow is minus 21 pips. IMO, with Forex, that's too small as it gets very volitile. Witness last night when there were 40-pip swings within a 15-minute candlestick.

2) I too, closed a trade from another computer. Had to reboot EA from original computer after that.

As with Craig's comments, I don't think the EA can trade unless we reboot it, following an additional position.

3) Your long @ 1.5870 should have been a winner by now. Please advise FAP's entry time for me to ascertain DD. That position didn't look like it had a very large DD, perhaps 20 pips. Congrats!

Craig,

Doesn't look like the new version 2.0 is different in regards to having to reboot EA after an additional manual trade.

Thanks for asistance in posting statements. Will send as we progress.

Currently in long @ 1.5810 triggered 03:20 chart time. Again, EA entered near top of swing.

Retraced to 61.8 fib @ 1.5787 and bounced. Now sitting on 50% fib @ 1.5792 and at minus 18 pips.

There was an error in my statement regarding the EA closing losing trade.

My brother was watching charts and manually exited those 2 for losses (my appologies. )Therefore, none of us have witnessed this EA exiting a trade at a loss, outside of the 1st of the month. This is bothersome to me. More reason the share ideas/strategies.

Wow, to my surprised we broke through the 1.5900 barrier and are currently trading at 1.5938. I closed 3 FAP trades for 25 pips each overnight. I had an open buy at a 5 pip floating loss which I just manually closed; The t/p was too high in uncharted waters. I just entered a manual short position now with a t/p at 1.5875.

Hi All,

Since starting live on April 10 I have had 7 trades. All win. that is 140 pips. I started to believe in this EA. Although you get the DD sometimes but it seems it will always come back. My concern is that it will always start a trade on the higher limits and I have not seen a short trade yet. I can not say I am not happy, though :)

I am using default settings. trying to resist the urge to put a SL (That scares me as i have been burnt before with oher EAs). May be a hedge trade would be useful but it may be hard sometimes as you will need to monitor the trades all the time.

Not sure yet on the differences between Craig's and the default. Do we have any established results proving that either settings is better?

Well, yesterday I stayed in the painful long trade from 1.5870.

It was down as much as 80+ pips at some points.(for me $400)

I resisted exiting, and this morning I'm up 60 pips $300 at $7300. So--The trade/trades over night won.

This morning The EA opened a long at 1.5960. I'm not happy about this trade. It's uncomfortably close to a major resistance top and theoretically in a much worse starting point then yesterday's trade.

I will watch carefully but let it go within reason.

I wonder if it might not be better to disengage the EA when it reaches into a major resistance top, and turn it on after pull backs or after a convincing breakthrough of the top i.e. 1.6000

Jim

fxisland,

My EA has opened a few profitable short trades, in fact all were good.

However, I would have thought this mornings trade should have been short; I don't understand how it decides which way to go.

It's now long at a major top.

Jim

Hi Jim,

You mentioned that your EA opened short trades. I am confused. Are you using the latest FAP EA? Same default settings. My EA has only opened long positions since April 10. How does the EA decide to open a trade (long vs short) is still to be known....

fxisland,

It opened a short last Friday morning at 1.5770 and I was worried. I was sitting on a 27 pip loss when the market closed.

The market gapped down when it re-opened and being short, I picked up 80 pips. Then it made additional winning trades after the gap.

Why it opened long today I have no idea.

I personally would have been in a "wait and see" mode with a tendency toward short.

Jim

fx-

I have the newest version and it does make short trades.

(forex autopilot universal ?).

It seems to want to trade all the time! I'd like it to take a moment to regroup.

Jim

Jim,

Yes, it seems it want to trade all the time!

You mentioned (Autopilot universal?)

Are we talking about the same EA?

The one on http://forexautopilot.com/

Mine did not make any short trades so far.

Fxisland,

Its the same autopilot. I had trouble activating mine and support sent me and activated one that displays as "fxautopilot universal"

I saw on another blog that it was the latest. The "universal" part may be something they call it when they have to activate it for you.

It took profit on that last long trade (it worked) and opened another long at 1.5996.

Jim

My concern all along has been the lack of short positions. The reason that I switched from my custom aaa:bbb setting of 9:10 to the default of 13:14 is because I read a post on another blog here. This blog shows live demo statements trading with both settings and it seems that the 13:14 setting places more sells; however, mine hasn't triggered a short in awhile.

I don't think that this EA is perfect and it should be actively monitored. My account is up 24% in a little over a month of trading despite taking a couple huge losses that were uneccessary. I've been using this EA as a tool along with placing hedge trades. Right now I have it turned off until either the price comes down below 1.5900 or finally breaks through 1.6000.

Welcome fawzi,

Nice to have another user that is trading live on this blog. All very good questions from you and Jim. Let's attempt to get organized and share info/results. My suggestion is for everyone to take a pic of statement and e-mail to Craig. He will post. Please note your aaa & bbb settings with pic.

1) I have experienced short trades with newest version of this EA v2.0, but almost all have been long.

Jim, I also watch it break 1.5900 last night. Took 1 winner for default 20 pips.

Since I was in that long from 4-16 03:20 @1.5820, I decided to manually place a stop just below a fib support of 1.5770 to limit DD to 43 pips or 2% of account balance. Took profit at 07:54 @ 1.5830.

Using Craig's adjusted settings aaa13 & bbb14.

Just for testing purposes, loaded EA onto other pairs and have not seen a trade since last winner. Probably have to reload EA. Don't know if it locked up due to my manually inputting S/L suring trade.

2) fawzi,

We are all pretty new to this EA and as mentioned need to compare settings. I did advise Craig that on April 10th, his settings seem to do better than my then default, but sampling size of course too small.

Craig experience 3 long winners last night while my EA locked up. We are both on same settings and using latest version, while Jim is on default aaa & bbb.

3) Jim, you mentioned 80-pip win. Is your setting not for 20-pip take profit?

4) Yes, this EA is hyperactive. This brings up a point. The law requires anyone trading more than 4times per day, for 5 consecutive days to have a minimum of $25K in account. Don't know how this is enforced as the last time I exceeded that balance, law not in effect. This is also noted in FAP manual.

5) I can understand Jim being exhausted from FAP's activity. There is a function built-in that allows user to have EA ask if you want to initiate trade. Since we are dealing with the infamous part of trading, psychology, it may end up being a double-edged sword. Perhaps a limited use of this function is applicable.

6) As far as Jim's question on how EA decides which direction to trade:

From what I can see, as well as from their booklet, it is a trend-based system. From my experience, most systems are this way.

In the early days, most traders simply used moving average cross-overs, with little or no understanding of fibs/support & resistance.

Their booklet only mentions a handful of indicators such as fractals, alligator, williams percentage rate, demarker. While I can provide you with a link that explains each indicator, it won't conclude how they have put it all together, which of course is proprietary.

Fractal is a pivot indicator, and therefore they do have at least a couple of these.

7) Another observation is that since developer advises to use only with EUR/USD pair, it relies on volatility. This drives any move. The EA looks like it was originally defaulted for 25-pip take profit (as per Craig's original version), and was adjusted to 20 pips. In all honesty, I thought even 20 pips using a 1-minute was excessive.

8) I think our major objective is how to smartly limit DD. If I can load EA on another demo, without intereferring with trades, I'll set S/L at 2% max of account to see what record it achieves. Again, it's a lot to ask for us to take large DDs. Doesn't make money management sense.

9) One reason we may have different trades is the different data feeds we are using. Please mention which feed/broker with your pic if you don't mind.

Hi Fx-

My setting is 20 pips TP.

However, on friday night, the market closed and I was short in an open trade.

When the market opened (for me on Sunday evening EST,) it opened gap down.

The EA exited at the open and captured the 80 pips. It then traded in and out on the way back up.

Jim

Jim,

May the force be with you. 80 pips is pretty good, but I suppose it could have ben the other way around, without a S/L.

Craig,

Thanks for link to test results! Good as he is testing on 2 feeds/brokers. Both samplings over 3-4 weeks and 95-95% winning ratio. Probably had some huge DDs that came back. Noticed he did have a handful of trades closed by EA. The losses, while large, were a small % of overall trades.

Herein lies quandary. If we let it run unmonitored without S/L, better trade a very low amount of lots to withstand perphaps as much as 200-pip DD.

What would be a compromise? Let it run this way until a reasonable time window expires. Then manually enter a stop loss or hedge? What if it's minus 200 pips after say 24hours? Instead of manually entering a S/L, can have a pending hedge?

I created a spreadsheet that calculates return based on inputted winning %, avg win, avg loss, etc.

If the link's test results are used:

95% =win

20 = avg win

110 = avg loss

# lots = 1 per $30,000

Results = 324% per year without resizing as account grows.

Leaves out maximum exposure on DD as % of account. If this number is 150 pips, it would represent 5% of account.

If win % dropped to 90%, return = 168% per year.

Oops, forgot to mentioned spreadsheet based on 60 trade per month, which would be incorrect according to link.

Looks like the 2 test had 27-28 trade for 3-week period, which would translate to about 37 trades per month. In this case:

90% win = 104% return per year

95% win = 200% return per year

If Craig can advise on how to do it, will be happy to send spreadsheet to all.

I downloaded autopilot yesterday and cannot activate it. When I put in the id# in members area today then get code all that comes up is another page saying welcome and an email has been sent...

Of course no email.

I guess I should have activated it the same day I downloaded it.

I couldn't get mine activated either when I first downloaded it.

I contacted "support" and had to show proof of purchase. They then sent me an "activated version."

Jim

My impressions of this co. go up and down just like the forex market.

Didn't like cheesy site. Liked videos explaining things every step of the way. Don't like not being able to activate.

Hope I like the money it seems capable of delivering.

By the way, it says to let it to do it's thing and at the end of the year 96% profitable trades.

That said, someone should have it running in demo mode without interference to see what it's really capable of on it's own.

That would be a good "controll group" against which to judge various other strategies I see posted here.

All very very interesting.

Anyway, thanks much guys!

Customer support responded to me about the activation problem after about 24 hrs.

Jim

I think I'm going to start a demo account and run it "hands off" 24/5. I will then post my live account results and the demo results. I can't help interfering with the live account, since it is REAL money.

fxisland - I can post the spreadsheet file in my next blog post if you email it to me. I'll be sure to give you credit for it.

Everybody - I'd be glad to post anybodys results in my weekly update. The more the merrier, just email them to me and include your settings.

Hi all,

Looks like nobody has had this EA (at least the updated version)prior to March and thus results still trickling in. Craig's link to another tester, that also uses settings aaa13 & bbb14, is good reference.

Need to clarify which broker/feed everyone is using, please comment.

The pair tested 1.600 at 18:00 chart time. Many traders short ahead of this even number, especially if it is the first test of an all-time high. It finally retraced to 23.6% fib, which represents aobut 50-60 pips in profit.

Can anyone post their performance for today 4-16, as my EA locked up probably due to my manual insertion of a stop loss.

Will send Craig spreadsheet.

Thanks

Ok.

After reading some posts that FAP performs better on forexte.com I opened a demo account and used the MT copier to copy trades to my FXDD live account. You have to change the expiration hours to 8 hrs. It is working fine even with the 4-5 digit difference as FXDD picks up the first 4 digits. I did see forexte picking up a short sell today.

I'm getting back to thinking about leaving it alone.

Also a correction, one of the last long trades I worried about I said was placed at 1.5996. Should have written 1.5966.

But--

I manually closed it out at a 20 pip loss

(-$100) The EA opened a new one at 1.5953 and I let it run. It closed the trade with a 20 pip

($100) profit over night.

When I first started using the Demo, I would come home each day and look only at the bottom line. Some days nothing would have seemed to have happened. Several days later the account would be way up. Maybe a month was premature to use as a test but I left everything alone as the "play money" increased. Now I am exiting trades only to find if I left them alone they would have been okay anyway. Now that it's real money I'm all over this thing and I don't believe any of my interventions have actually helped my account. In fact I almost exited a trade that eventually resulted in capturing 80 pips.

Of course I will still watch this as MM is in my blood. Still none of my tampering really resulted in better ultimate performance.

Yesterday morning my account showed $7300, this morning my account showed $7400 (without looking at the trade in progress.)

Currently I'm down 40 pips $200) on a trade

(1.5970) that began early this morning. My intention is to let it go despite it's close approximation with the almighty 1.600.

If it breaks 1.600, IMO there is likely a good short term run in store.

Jim

I use forexte. I ran two demo accounts and the Forexte did a bit better than the other.

Jim

Hello

Im new on this market Im from Slovenia. I have demo account on MT4 and i have done some manual trading. I'm reading this blog some time now and i wonna start for real money. But i have only limit of 300 USD for this experiment.. Can enybody help me how ca I start live trading..do i need to make agreament with a broker house or how do i do this?

Thanks

Leon

I have re-read settings on Craig's link to another trader's 2 demo accounts.

1) Default settings: Mar 12th thru Apr 4th. Trading .10 lots on $5K.

27 total trades. 26 wins 1 loss

13 consecutive wins. avg. win $22.80 (20 pips)

1 loss. avg. loss -$109.80 (110 pips)

There were 6 short trades.

After swaps, gain = $415.00 or 8.3%

__________________________________

2)

Custom settings. Mar 7th thru Mar 31st. Trading .10 lots on $3K acct.

28 total trades. 27 consecutive wins. 1 loss

Avg. win $21.55 Avg. loss -$132.00

There were 3 short trades.

After swaps, gain = $449.86 or 15%

Let's base on $5K start balance, return = 9%

__________________________________

Demo #2 had adjustments to settings: aaa=9, bbb=10, take profit =25, trailing stop=20.

__________________________________

Side-by-side comparisions on same days:

Mar 12th.

#1 = 3 win buys for 20 pips each.

#2 = 3 win buys. 2 at 25p 1 at 3p.

1 win short at 25p

_________________________________

Mar 13th.

#1 = 4 win buys at 20p each.

#2 = 7 win buys. 5 at 25p 2 at 1p.

_________________________________

Mar 14th

#1 = 1 win buy at 20p

#2 = 1 win buy at 25p

________________________________

Mar 17th

#1 = 2 win sell & 3 win buy 20p

#2 = 2 win sell & 4 win buy 25p

________________________________

Mar 18th

#1 = no trades

#2 = 1 win buy 25p

________________________________

Mar 26th

#1 = no trades

#2 = 1 win buy 25p

________________________________

Mar 31st

#1 = 1 loss buy minus 110p

#2 = 1 loss buy minus 132p

________________________________

Still too small sampling size, but interesting nevertheless.

When using the spreadsheet/calculator sent to Craig, with these parameters:

Leverage = 3:1

Avg Win % = 85%

Avg Win = 25 pips

Avg Loss = 110 pips

ROI = 63%/year not including swaps.

Unable define Max. Stop Loss, user must decide on their own what tmax exposure/DD (pain) they can handle.

When above is inputted with Avg Win = 20 pips, ROI drops significantly to 6.7%/year.

After monitoring everyone's demo and live accounts for another couple of months, we should have a better handle on this EA.

We need to ascertain whether it is too risky for leverage exceeding 2.5:1 due to no or high Stop-Loss.

Although sampling is too small thus far, the side-by-side performace comparision, seem to indicate that a 25-pip Take Profit setting does not affect win %.

Thanks fx-

I will contribute screen shot info when I learn how to do it.

Still sitting on a long trade from 1.5953 and intend to let it ride. Perhaps it will close itself out if it gets too bad. That's the only way I think we'll ever find out.

LT, I don't think I'll lose; 1.600 is coming and there will likely be significant upside from there. The dollar is not in good shape.

The psychological problem using this EA now comes as a result of watching the chart all the time and seeing many possible missed trades. I wasn't doing that when I first started using FAPS on the demo account. The financial problem is yet to be determined i.e. the EUR/USD goes down never to recover.

Were you or anyone else able to find out if entering an "additional" trade in the same direction an EA trade disables it? I was close to opening a long down at 1.5875 or perhaps entering a limit order stink bid down at 1.5775. Since I believe the EUR is destined to retest 1.6000 I wouldn't mind being long at either of those levels.

Jim

Jim,

As EA users, we need to remind ourselves that the reason we use a robot is to take away the emotions from our trading. With all due respect, your stated concerns are typical of this syndrome (similar to 90% of non-institutional traders).

What I've learned, the hard way, is that any expert/analyst can be wrong. All of the news about the USD facing further weakness may turn out to be true. As traders trying to get only 20-25 pips, it should not interfere.

On any given day, economic news and conditions can trigger moves in either direction. From a technical analysis basis, we can read some of the momentum, turning points, and support and resistance.

An EA uses technical analysis of recent data.

For every "move", there will be a retrace. When I mention "fibs" (fibonacci), it is an important tool to measure retrace, as well as extension of the last significant move. BTW, the EA probably does not consider support & resistance.

If your position was entered at peak the last long move, it has retraced. When if reaches its original starting point (100%), and exceeds that, then it becomes a new move against your position.

I know, all too technical. Can't help it, used to teach the subject :)

As far as your question about entering an additional long:

I looks like any additional trades on the same platform will interefere. As a matter of fact, after I manually entered a stop on my last winner which closed on 4-16 07:54, it locked up. I have rebooted both my computer and reloaded EA. Not one single trade since then. Will have to e-mail support.

Cheers

Hi fx-

That is very sage advice. I'm down 200 pips ($1000) into the $2400 profit generated by the EA.

I'm still staying in as I feel a whipsaw coming. If I get out it will come. Fortunately I'm still playing with profit capital and have not gotten into the original investment. I looked at this experiment from the beginning as involving risk capital. I don't treat my other investments with this much abandon.

I will exit if/when it hits my original investment level and play it much more conservatively next time around.

Let me know how it goes with customer support.

Jim

Hey Jim,

I finally got a trade. Unfortunately it's a sell and down 200 pips on demo. I treat it seriously however. This is the most glaring aspect of this and other EAs that doesn't use a S/L.

Aside from inputting a S/L, the other option is to use less leverage. Craig should post the calculator on his blog any day now. Use it to plug in your maximum exposure/DD, etc. and it will spit out how many mini-lots to trade.

Looks like Interbank FX broker charging commission. Can anyone advise?

Finally got it running and a minute later I am at almost

$300 down. LOL.

Now a few hrs. later I am almost at the break even.

Starting to understand hedging. Please correct if I'm wrong but if the EA takes a long position and you experience large drawdown, you place a manual long position at the current low to take back the loss. This assumes that you believe that the EA is right in the end and it will go up - even if it doesn't necessarily make it to the take profit high. ...Or something like that?

Yes a leverage calculator would be great. I believe fxinsights is great also. Between this place and them, I may actually begin to understand this!

Keep up this most interesting experiment guys!

While I'm trying to remember my damn password here, I guess it just closed the trade at a $200 gain. Too bad it's not real money. By the way how is forexte (forex.com?)? (The autopilot default broker I guess.)

It placed another long for a gain of $180 (I closed it manually since very close to $200 target).

Total $380 today. Man it should be real money!!!

Since I closed the last trade it placed, will it wait for the right indicators to place the next trade, or do I have to reset it? So far no other trade entered - could just be that I'm impatient.

Hi all. Just wanted to comment that I will be out-of-town this weekend and hope to post results and fxisland's calculator on Sun night.

Hi newtrader,

From my experience you can exit a trade and the EA will eventually start another one.

I still don't know what makes it decide when or in which direction to enter a position. For me it went back in too fast.

Mine entered one yesterday near resistance at 1.5953 and I've taken a wild ride down as much as 240 pips ($1200)

Currently I'm down 138 pips ($770)

with the market closed. Thus my profit has been reduced to $1630 with the loss I'm holding through the weekend.

I'm worried about a gap down when the market re-opens on Sunday evening.

I'll make decisions about my next move when the market re-opens and I see what happens.

fingers crossed,

Jim

Hi,

I believe hedging can be useful with this EA. The problem is one needs to babysit the EA and manually enter a trade in the other direction once FAP makes a trade. It would be great to automate this hedge trade. Do you know of an EA that would monitor the account and once a trade is triggered it will open another trade in the other direction?

Right now I do not have a problem opening other trades in my live account since I am running FAP on another demo account and copying the trades using MT copier to my live account so opening and closing other trades in my live does not really affect EA performance.

By the way, I contacted FAP support and I asked about the EA electing to make long trades rather than short trades. They answered by saying that "It preferable does long trades"

I am currently sitting on a long trade that went down as far as -200 pips and went back to -154 pips. I hope to get a gap up on Monday!!

Hi Fawzi,

I'm not familiar with MT copier. Are trades instantaneous with the EA on the Demo? If I understand correctly, this may solve the problem of multiple trades disabling the EA.

My instinct is to get out near my entry and see where the trend is headed. However that will derail my "experiment." I'm prone to careful mm and this EA doesn't permit it.

Ultimately, I've come to believe this approach depends on a large enough account and proper leverage with regard to lot size. I'm glad I decreased mine to .5

but now think it still may be too large.

A 1200 pip DD would nearly destroy this account. While it seems unlikely, it is certainly a possible scenario. There is pretty strong support at 1.5340

(-630 pips)

which would translate to a $3100 loss in my account value.

I was fortunate the EA captured a $2400 profit when I went live.

Currently the EA seems determined to be long. When I exited using another computer last Thursday, the EA jumped back in not far from where I wanted to be out.

I too am holding long over the weekend.

I'm with you hoping for a gap up on Monday.

Jim

"This EA prefers long positions"

it may be monitoring the long-term trend, which has been overwhelmingly the case with EUR/USD.

_______________________________

"know of an EA that hedges"

While I'm not giving up on this EA, I am studying breakpoint EA. It hedges but also pyramids, which can be too stressful for some users.

With FAP, can manually set a pending opposite order in a price area we believe is support or resistance. Might have to do it on a separate platform.

Fawzi, you're the man. You figured a way by copying. Be so kind to break it down for us?

_________________________________

Suggest traders draw fibonacci on both long-term and short-term charts to realize where support/resistance levels are.

Place your hedge near these levels accordingly.

Inserting a stop loss after position has been in play too long is another option. The S/L can be placed beyond a fib.

If you don't want to draw fibs, there are sites that list support & resistance levels. They may also be named "pivot levels". I'll send a link.

_________________________________

Weekend

If you're stuck in a trade approaching weekend, place a hedge. This locks in the position's plus or minus until market resumes. Cost is spread on hedge which is peanuts.

You'll need to release/close hedge at some point. Who knows, you may choose to close original position and go with hedge position

Hi Jim,

Yes the MT copier can copy a trade from your demo platform into another PT (Live, for example). i tried it and it works well. That is how I am able to trade another EA into my account. I am now working with a programmer to program an EA that will open a hedge trade once FAP open a trade.

By the way, do you know anything about another EA called auto pilot but trades GBP/USD. Here is the web site http://www.forex-autopilot-system.com/.

Hi Fxisland,

The MT copier is easy to use. I can email you the software. I came to know about it from CK blog on facebook. It has a help file. It is easy to run and it takes 5 min to set up.

Jim, if you are interested I can email you the file.

Thanks for your notes on the fibo and the pivot. My thought is if another EA can open another trades in the opposite direction once FAP place a trade would not that be a good trade to hedge and lower the risk. I am trying to find a way that is less manual and really an 'auto pilot' style!

Hi fawzi,

Yes, I think we all can see that we have to hedge with an EA that doesn't use stop and doesn't pull losing trades soon enough for our taste and pain tolerance.

"if another EA can open another trades in the opposite direction once FAP place a trade would not that be a good trade to hedge and lower the risk."

If I'm understanding your question...are you saying that you want to hedge right after FAP enters a trade you don't like?

Thanks for your efforts in R&D with your programer. You know, the developer of FAP should really do this to make it a better product. Another EA is in the process of trying to program a hedge as they also do not use S/L. Will let ewveyone know if they are sucessful.

The auto pilot system link. This is the 3rd EA with similar name. I had actually visited that site prior to jumping in with our FAP. It is certainly confusing. Don't know who was first, but the others are trying to capitalize on the original's fame. This one has just 4 months of statement and probably trend-based as well. Their site doesn't really provide much info as far as when they exit trades, etc. Guess we'll have to rely on bloggers that are testing it.

Thanks and look forward to e-mail with MT copier!

Hi Fawzi,

I am very much interested in obtaining and understanding how to install and use MT copier.

When I'm away from my home EA computer, I can exit trades but can't disable or stop the EA from entering another trade where I exit.

Having more control would be great though in some way's it may defeat the FAPS strategy. (what ever it is) Again I think its based on position trading which is a long term approach requiring adequate funding.

They say up front that "you may possibly have very bad results for several days or even several weeks but ultimately if you leave it alone you will win." This suggests to me that you have to have faith that the trend and your funding remains intact while the EA trades. It has proved to be effective while trading on the "right side" of a trending market. However, DD's could be disastrous if funding is not adequate for your chosen lot size risk.

Thank You!

Jim

forex auto pilot system does have a FAQ tab that I didn't see in my haste.

http://www.forex-autopilot-system.com/faq.html

It operates on a daily chart and thus trades only about 5-10 times per month. The risk factor/leverage should be adjusted accordingly, as DD will be huge on the long-term chart. Profit target/take profit is set at 255 pips.

It's been a very good trend market for several month. These EAs may not be anywhere near as good when the market gets choppy. Buyer beware.

Hi Jim,

Your assessment is correct, in my opinion. It is easy to say stay in the trade when it's been a great uptrend for EUR/USD. Why do you think it they say it can only work on this pair?

If applied to another pair, results would be mixed. Risk/reward would be bad.

Hi Jim/Fxisland,

To which email do you want me to email the Mt copier?

The Mt copier should run on a computer where you have two platforms running and you want to copy trades from one PF to another. Just to make sure we are on the same page. I currently use to copy trades from Forexte.com demo for FAP to my live account.

Jim, when I am away from my home computer (the one that runs the EA) I use logmein.com if I need to have control of my PF and EA's. It is like sitting in front of your home computer but the screen is actually in front of you anywhere in the world.

fxisland,

the EA on http://www.forex-autopilot-system.com/faq.html

Uses GBP/USD on a daily chart while our FAP uses EUR/USD on a 1 min chart. Interesting.

Hi Fx-

I noticed that the FAQ's from your link recommended GBP/USD pairs as opposed to EUR/USD. Is this new or perhaps an older version?

As for time frame, are they recommending a daily setting as opposed to 1M ? Not sure I understood that part. It mentions 5-10 trades per month. Seems like current settings have produced 5-10trades per week. Though, I could imagine the present trade I'm in lasting for weeks.

Let me know what you think.

Jim

fawzi,

furst@flash.net.

TIA,

Jim

I don't want to speak for anyone else, especially since I am very new to all this, but forexautopilot and forex-auto-pilot are different EA's.

From what little I know they may both be based on forexkiller only tweaked by specific companies, but of course I'm not certain.

(At one point when I was not able to activate, I called the forexautopilot help line and could have sworn they mentioned forexkiller.)

Also, forexautopilot did close out a losing short trade at -$90 I believe, only to reenter short over the weekend.

If we are talking about the same EA, strange that others are long over the weekend while I'm short.

Thanks.

My long began early Thursday morning around 3:30 Am before the Friday EURUSD drop.

Perhaps your short trade began later when it read the indicators differently.

Forexkiller also resells the "forex autopilot" we are discussing. That's probably why you have seen their name. They seem to be handling some support issues.

Jim

Hi Jim,

fawzi referred to another company with similar name that uses the daily chart. It's name is forex-autopilot-system. Crested by Mark Copeland.

The EA discussed here was created by Marcus Leary.

Forex Killer, by Andreas Kirchberger, often had autopilot attached to description.

Fx-

I,m using Markus Leary's FAPS.

I noticed in the FAQ's from the site your post referred to, the EA was linked to the GBP/USD and required "daily setting."

That is the other system--

Unless I misunderstood?

Jim

Hi Jim,

Yes that is another system.

I feel a gap down coming on market open. Hope not for my sake, but for those who entered the weekend short, (newtrader?) you may get rewarded.

I'm just basing this on my rheumatism---

Jim

Off topic:

EUR/USD has stalled after a retrace from recent down move. It needs to break 1.5850 before heading to next resistance levels:

1.5875

1.5921

1.5978

Techincal analysis trades make money between the fibs. So go to next fib with trend and some play the bounce.

Post a Comment